Bank Guarantees

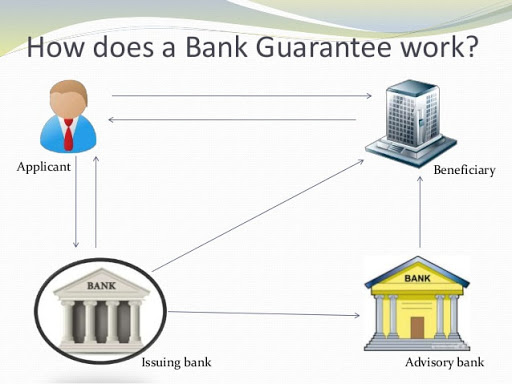

A promise made by the bank for meeting the liabilities of a debtor when a person fails to fulfill his contractual obligations. There are two types of bank guarantees – Direct or indirect:

A direct guarantee is one where a bank is asked to provide a guarantee by its account holder, in favour of the beneficiary.

In an indirect guarantee, a second bank issues a guarantee in return for an already issued guarantee. When the second bank suffers losses when a claim is made against a guarantee, the issuing bank will make sure that it compensates all the losses.

Guarantees provide comfort to the beneficiary; in case the applicant fails to meet his obligations (either financially or by performance) as per the contract made bet…